Recession Tracker

Ein umfassendes Tool zur Wirtschaftsüberwachung, das einen Rezessionsrisiko-Score von 0-100 bietet, über 20 Wirtschaftsindikatoren verfolgt und tägliche KI-gestützte Analysen liefert, um Investoren bei fundierten Entscheidungen zu helfen.

https://recessionistpro.com/?ref=producthunt&utm_source=aipure

Produktinformationen

Aktualisiert:Dec 16, 2025

Was ist Recession Tracker

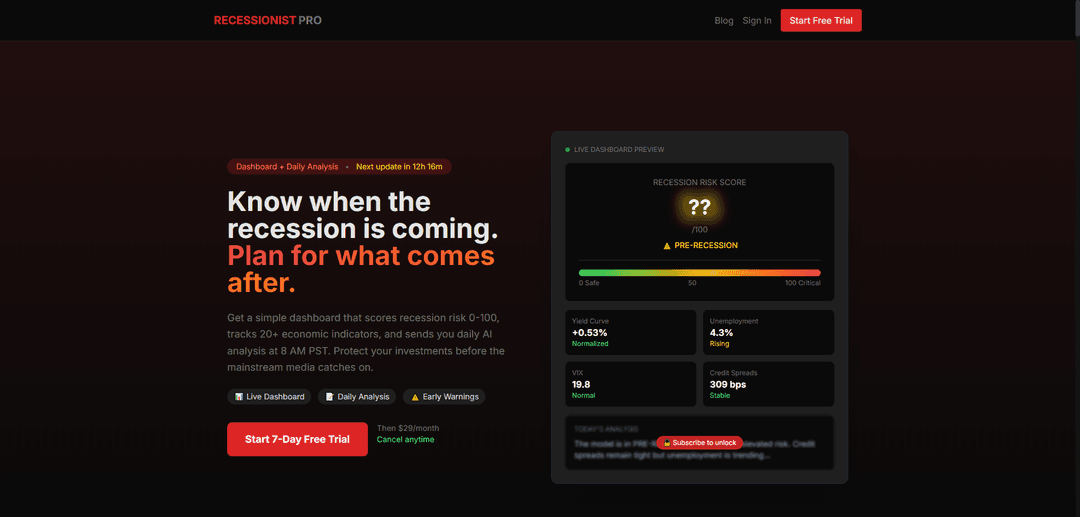

Recession Tracker, auch bekannt als Recessionist Pro, ist eine hochentwickelte Plattform für Wirtschaftsinformationen, die entwickelt wurde, um vielbeschäftigten Berufstätigen und Investoren bei der Überwachung von Rezessionsrisiken und Marktbedingungen zu helfen. Dieses von Tom Spark entwickelte Tool kombiniert Echtzeit-Datenanalyse mit makroökonomischen Indikatoren, um klare, umsetzbare Einblicke in den Zustand der Wirtschaft zu geben. Die Plattform bietet ein vereinfachtes Dashboard, das komplexe Wirtschaftsdaten in einem leicht verständlichen Format zusammenfasst und es Benutzern zugänglich macht, die auf dem Laufenden bleiben möchten, ohne Stunden mit der Analyse von Märkten zu verbringen.

Hauptfunktionen von Recession Tracker

Recessionist Pro ist eine KI-gestützte Plattform zur Wirtschaftsbeobachtung, die eine umfassende Rezessionsrisikoanalyse durch ein Live-Dashboard bietet, das eine Risikobewertung von 0-100, über 20 Wirtschaftsindikatoren und eine t\u00e4gliche KI-generierte Analyse anzeigt. Der Dienst konzentriert sich darauf, Benutzern zu helfen, verschiedene Phasen von Konjunkturzyklen zu bew\u00e4ltigen, indem er Schl\u00fcsselmetriken wie Zinskurven, Arbeitslosenquoten und Kreditspreads \u00fcberwacht und Einblicke in einem leicht verst\u00e4ndlichen Format t\u00e4glich um 8 Uhr PST liefert.

Live-Dashboard mit Risikobewertung: Echtzeit\u00fcberwachung des Rezessionsrisikos auf einer Skala von 0-100, Integration von Daten aus \u00fcber 20 Wirtschaftsindikatoren, einschlie\u00dflich Zinskurven, Arbeitslosenquoten und VIX

T\u00e4gliche KI-Analyse: KI-generierte Wirtschaftsanalyse, die um 8 Uhr PST geliefert wird, fasst wichtige Ver\u00e4nderungen zusammen und bietet umsetzbare Einblicke in einem pr\u00e4gnanten Format

Drei-Phasen-Konjunkturzykluserkennung: Automatisierte Erkennung und Analyse von Vorrezessions-, Rezessions- und Erholungsphasen mit spezifischen Metriken und Strategien f\u00fcr jede Phase

Politische Risikomodellierung: Einzigartige Analyse politischer Unsicherheit, Handelsspannungen und fiskalischer Risikofaktoren, die traditionelle Modelle oft ignorieren

Anwendungsfälle von Recession Tracker

Investment-Portfolio-Management: Hilft Investoren, fundierte Entscheidungen dar\u00fcber zu treffen, wann sie ihre Portfolioallokation zwischen defensiven und wachstumsorientierten Anlagen basierend auf den Konjunkturphasen anpassen sollten

Immobilien-Timing: Unterst\u00fctzt bei der Verfolgung des 18-j\u00e4hrigen Immobilienzyklus, um optimale Zeitpunkte f\u00fcr Immobilientransaktionen zu identifizieren

Gesch\u00e4ftsplanung: Erm\u00f6glicht es Unternehmen, sich auf wirtschaftliche Ver\u00e4nderungen vorzubereiten, indem es fr\u00fchzeitige Warnsignale f\u00fcr potenzielle wirtschaftliche Abschw\u00fcng gibt

Pers\u00f6nliche Finanzplanung: Hilft Einzelpersonen, ihre Ersparnisse und Investitionen zu sch\u00fctzen, indem es klare Signale daf\u00fcr liefert, wann konservativere Finanzstrategien angewendet werden sollten

Vorteile

Zeiteffizient (ben\u00f6tigt nur 5-10 Minuten t\u00e4glich, um auf dem Laufenden zu bleiben)

Transparente Methodik mit nachweisbaren Datenquellen

Erschwinglich im Vergleich zu Konkurrenzdiensten

Keine Upsells oder versteckten Geb\u00fchren

Nachteile

Relativ neuer Dienst mit begrenzter historischer Erfolgsbilanz

Verl\u00e4sst sich stark auf traditionelle Wirtschaftsindikatoren, die m\u00f6glicherweise nicht alle Marktdynamiken erfassen

Einziger Entwickler/Betreuer k\u00f6nnte ein potenzielles Risiko f\u00fcr die Kontinuit\u00e4t des Dienstes darstellen

Wie verwendet man Recession Tracker

Zugriff auf das Dashboard: Melden Sie sich beim Recessionist Pro-Dashboard an, das täglich um 8:00 Uhr PST aktualisiert wird. Das Haupt-Dashboard zeigt den Rezessionsrisiko-Score (0-100) und wichtige Wirtschaftsindikatoren an.

Überprüfen Sie den Rezessionsrisiko-Score: Überprüfen Sie den Haupt-Rezessionsrisiko-Score (0-100), der komplexe Daten in einer einzigen Zahl zusammenfasst. Werte über 50 deuten auf ein erhöhtes Rezessionsrisiko hin, während Werte über 70 auf ein hohes Risiko hindeuten.

Überwachen Sie wichtige Indikatoren: Überprüfen Sie die über 20 Live-Wirtschaftsindikatoren, einschliesslich Zinskurve, Arbeitslosenquote, VIX-Volatilitätsindex und Kreditspreads, die den ganzen Tag über regelmässig aktualisiert werden.

Lesen Sie die tägliche Analyse: Lesen Sie die tägliche schriftliche Analyse, die um 8:00 Uhr PST bereitgestellt wird und erklärt, was sich in den Märkten geändert hat, was am wichtigsten ist und worauf Sie achten müssen.

Identifizieren Sie die Wirtschaftsphase: Bestimmen Sie anhand der Dashboard-Indikatoren und -Analysen, in welcher der 3 Phasen sich die Wirtschaft befindet: Vor-Rezession, In-Rezession oder Erholungsphase.

Überprüfen Sie historische Diagramme: Vergleichen Sie aktuelle Indikatoren mit historischen Mustern aus vergangenen Rezessionen, um ähnliche Trends und potenzielle Ergebnisse zu identifizieren.

Überprüfen Sie die Anlageempfehlungen: Überprüfen Sie die phasenspezifischen ETF-Beobachtungslisten und Anlageideen, die für jede Konjunkturzyklusphase bereitgestellt werden, um Anlageentscheidungen zu treffen.

Überwachen Sie Frühwarnungen: Achten Sie auf alle Frühwarnindikatoren, die rot aufleuchten, bevor die Mainstream-Nachrichten potenzielle wirtschaftliche Probleme erkennen.

Recession Tracker FAQs

Der Rezessionsrisiko-Score wird auf einer Skala von 0-100 gemessen, wobei 0 sicher und 100 kritisch ist. Er kombiniert über 20 Wirtschaftsindikatoren, darunter Zinskurven, Arbeitslosenquoten, VIX und Kreditspannen. Der aktuelle Score im Beispiel beträgt 55/100, was auf eine VOR-REZEESSIONS-Phase hindeutet.

Beliebte Artikel

Die beliebtesten KI-Tools von 2025 | 2026 Update von AIPURE

Feb 10, 2026

Moltbook AI: Das erste reine KI-Agenten-Netzwerk von 2026

Feb 5, 2026

ThumbnailCreator: Das KI-Tool, das Ihren YouTube-Thumbnail-Stress löst (2026)

Jan 16, 2026

KI-Smartglasses 2026: Eine Software-orientierte Perspektive auf den Markt für tragbare KI

Jan 7, 2026