What is Accountable?

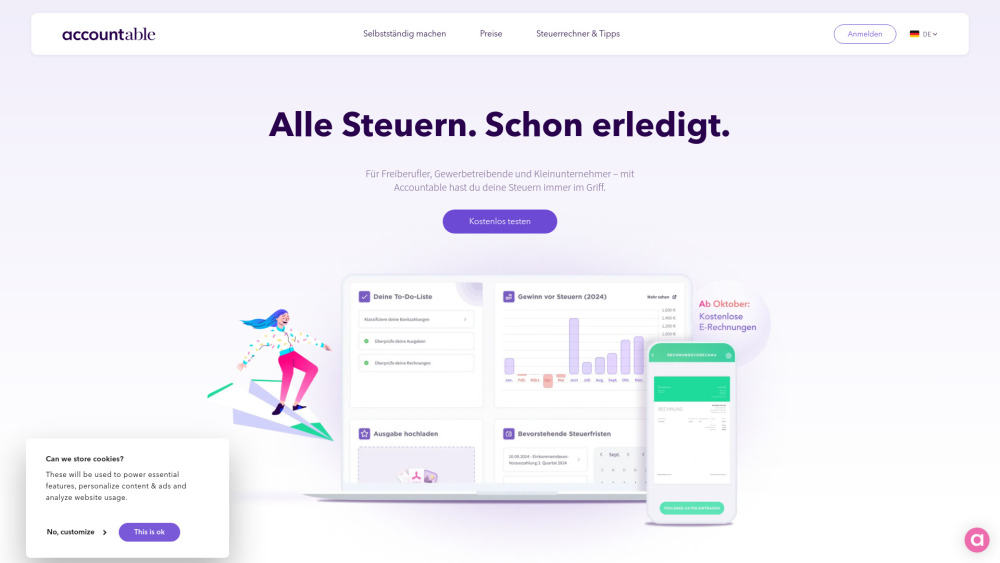

Accountable is an innovative tax management platform designed specifically for self-employed professionals in Germany. It simplifies the often complex and burdensome tax processes by offering a suite of AI-powered tools that ensure accurate and timely tax returns. Users can benefit from features such as error-free tax filing, unlimited invoice creation, expense tracking, and real-time financial overviews.

The platform's standout feature is its tax guarantee, which promises to refund users up to €5,000 for any back taxes resulting from errors linked to their service. With capabilities to handle various tax obligations including VAT and income tax, Accountable eliminates the need for traditional tax advisors, making it an accessible solution for freelancers.

Additionally, the app allows users to scan receipts for expense tracking, receive personalized tax tips, and maintain an up-to-date financial overview—all from the convenience of their mobile devices. By prioritizing user experience and reducing administrative burdens, Accountable empowers self-employed individuals to focus on their core business activities while ensuring compliance with tax regulations.

Use Cases of Accountable

- Freelancer Tax Management: Accountable simplifies tax management for freelancers by offering a user-friendly platform to track income and expenses. The app automatically generates the Einnahmenüberschussrechnung (EÜR) and provides insights into tax obligations, allowing freelancers to focus on their work without the stress of tax compliance.

- VAT Returns for Small Businesses: Small business owners can efficiently manage their VAT returns through Accountable. The app consolidates all VAT-related transactions throughout the year, automatically calculating the annual VAT return. This streamlined process ensures timely submissions to the Finanzamt, minimizing the risk of penalties.

- AI-Powered Tax Advisor: The built-in AI Tax Advisor provides instant answers to tax-related queries, ensuring users have the support they need at any time. This feature is particularly beneficial for those unfamiliar with the complexities of German tax law, offering personalized guidance to enhance compliance.

- Document Upload and Management: Users can easily upload invoices and receipts directly into the app, which organizes and categorizes them for easy access. This functionality not only simplifies bookkeeping but also automates the generation of financial reports, allowing for better business insights.

- Collaboration with Accountants: For those who prefer to work with an accountant, Accountable offers the "Accountable Expert" interface. This feature allows users to share necessary documents securely with their accountant, facilitating collaboration while maintaining user control over their financial data.

- Error Guarantee for Tax Returns: Accountable provides a unique error guarantee, covering fines resulting from mistakes in tax returns filed via the app. This assurance gives users peace of mind, knowing that they are protected against potential financial penalties due to errors in their submissions.

How to Access Accountable

Accessing Accountable is a straightforward process that allows you to manage your taxes efficiently. Follow these steps to get started:

Step 1: Visit the Website

Go to Accountable's official website. This is the main hub where you can find information about their services and log in.

Step 2: Sign Up for an Account

If you are a new user, click on the "Start for free" button. You will be prompted to create an account by providing your email address and setting a password. Ensure that your password is strong to protect your account.

Step 3: Download the App

For mobile access, download the Accountable app from the Apple App Store or Google Play Store. The app allows you to manage your taxes on the go.

Step 4: Log In

Once you have created your account or downloaded the app, log in using your email and password. This will take you to your dashboard where you can begin managing your taxes.

Step 5: Navigate the Dashboard

Familiarize yourself with the dashboard features. You can track expenses, generate invoices, and prepare your tax returns directly from this interface.

By following these steps, you can easily access Accountable and take control of your tax management efficiently.

How to Use Accountable: A Step-by-Step Guide

- Download and Install the App: Start by downloading the Accountable app from the App Store or Google Play Store. Create an account using your email and set up your profile with necessary details.

- Input Your Income and Expenses: Navigate to the income section to enter all invoices and cash income. For expenses, input relevant professional costs, ensuring you attach original documents for verification.

- Access the Tax Screen: Log into your account and go to the tax screen in the side menu. Here, you will find options for income tax returns, VAT returns, and profit & loss statements (EÜR).

- Submit Your EÜR: Click on the EÜR option for the corresponding year. If you have entered your invoices correctly, your profit and loss will be automatically calculated. Simply click "Submit to Finanzamt" to complete this step.

- File Your VAT Return: For those registered for VAT, select the VAT return option from the tax screen. Review the displayed calculations and click "Send to Finanzamt" to submit.

- Complete Your Income Tax Return: Finally, select the income tax return option. Follow the prompts to enter any additional personal data, including income from other sources and health insurance contributions. Review your information before clicking "Submit to ELSTER" to send your tax return directly to the Finanzamt.

By following these steps, you can efficiently manage your taxes through Accountable, ensuring accuracy and compliance with German tax regulations.

How to Create an Account on Accountable

Creating an account on Accountable is a straightforward process. Follow these simple steps to get started:

Step 1: Visit the Accountable Website

Go to the official Accountable website at accountable.de. This is the starting point for registering your account.

Step 2: Click on "Free Test" or "Sign Up"

Look for the button labeled "Kostenlos testen" (Free Test) or a similar call to action on the homepage. This will direct you to the registration page.

Step 3: Enter Your Email Address

You'll be prompted to enter your email address. This will serve as your login credential. Choose an email you frequently use to receive important notifications.

Step 4: Choose a Sign-Up Method

You can either sign up using your Google or Apple account for a quicker registration process or create a new account using your email. Select your preferred method.

Step 5: Fill in Your Details

If you choose to register with your email, fill in the required details such as your name, business information, and any additional information requested. This helps Accountable tailor its services to your needs.

Step 6: Agree to Terms and Conditions

Read through the terms and conditions. Once you agree to them, check any necessary boxes to proceed.

Step 7: Verify Your Email

Check your email inbox for a verification message from Accountable. Click the verification link to confirm your account.

Step 8: Log In to Your Account

Return to the Accountable website and log in using your email and password. You are now ready to explore Accountable's features and start managing your taxes!

By following these steps, you'll have your Accountable account set up in no time, allowing you to efficiently handle your tax needs.

Tips for Using Accountable Efficiently

Accountable is an invaluable tool for self-employed individuals looking to streamline their tax processes. Here are some tips to maximize its effectiveness:

- Organized Record-Keeping: Start with a systematic approach to managing your documents. Utilize the app's features to categorize receipts, invoices, and bank statements, ensuring everything is easily retrievable when needed.

- Stay Updated on Tax Regulations: Take advantage of Accountable's built-in features that provide insights into current tax rules and deductions. Regularly check for updates to keep your tax knowledge current.

- Utilize the App for Real-Time Expense Tracking: Input expenses as they occur to avoid a backlog. The app allows for quick entry, making it easier to categorize and track your spending in real-time.

- Leverage AI Support: Use the AI tax advisor feature for immediate assistance with tax-related questions. This can save you time and ensure you're making informed decisions.

- Regularly Review Your Financials: Set a routine to review your financial statements within the app. This habit will help you stay on top of your income and expenses, making tax season less stressful.

By implementing these tips, you can enhance your experience with Accountable, ensuring a smoother and more efficient tax process.