What is Accountable?

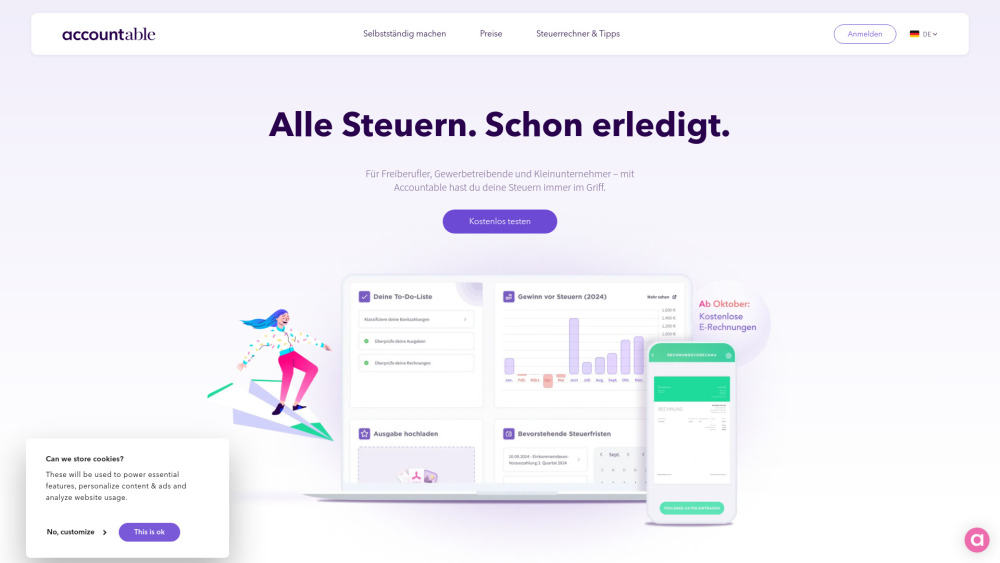

Accountable is a cutting-edge software platform specifically designed for self-employed professionals and small business owners in Germany. It offers a unique combination of bookkeeping functions and private tax return capabilities, allowing users to manage their invoices, expenses, profits, and taxes all in one place. This all-in-one approach sets Accountable apart from traditional accounting software, making it an invaluable tool for those looking to streamline their financial management processes.

At the heart of Accountable's offerings is its AI-powered tax assistant. This intelligent feature provides personalized guidance to users, ensuring that their tax submissions are error-free and compliant with German tax laws. To back up its commitment to accuracy, Accountable offers a tax guarantee, promising to reimburse users up to €5,000 for any errors resulting from the app's calculations or advice.

Accountable caters to a wide range of business types, including freelancers, tradespeople, and small entrepreneurs (Kleinunternehmer). Its user-friendly interface is designed to be accessible to those without extensive accounting knowledge, potentially eliminating the need for a traditional tax consultant in many cases. With flexible pricing options, including a free version for limited use, Accountable aims to empower users to take control of their financial responsibilities with confidence and efficiency.

Features of Accountable

Accountable boasts an impressive array of features designed to simplify tax and accounting processes for self-employed individuals and freelancers. Let's explore some of the key features that make this platform stand out:

- AI Tax Advisor: This intelligent assistant is the cornerstone of Accountable's offerings. It provides personalized tax advice based on each user's unique circumstances, answering tax-related questions and checking data for errors. The AI advisor also offers tailored tips to ensure that tax returns are accurate and compliant.

- Tax Guarantee: Accountable's unique guarantee covers fines up to €5,000 resulting from errors in tax returns generated by the app. This feature provides users with peace of mind, allowing them to submit their returns confidently without fear of penalties.

- Seamless Invoice Management: Users can create and send unlimited invoices directly from the app, track payment statuses, and send reminders. This streamlined billing process helps improve cash flow and keeps financial records organized.

- Expense Tracking: The app allows users to scan and save receipts, making expense management a breeze. Accountable automatically categorizes expenses and matches them with bank transactions, ensuring that no deductible expenses are overlooked during tax season.

- Mobile and Desktop Access: With both a mobile app and a web version available, Accountable offers flexibility for users to manage their accounts on-the-go. This feature is particularly valuable for busy freelancers who need to access their financial information anytime, anywhere.

- Bank Account Integration: Users can connect their bank accounts to the app, providing real-time insights into their finances. This integration helps users understand what funds to set aside for taxes and what they can spend, improving overall financial management.

How does Accountable work?

Accountable leverages advanced AI technology to provide users with personalized tax assistance, simplifying the often complex world of tax declarations and financial management. Here's a breakdown of how Accountable works:

- User Input: Users begin by inputting their financial data into the system. This includes information about income, expenses, and other relevant financial details.

- AI Processing: The AI-powered system processes this information, categorizing expenses, calculating tax liabilities, and identifying potential deductions.

- Personalized Guidance: Based on the processed data, Accountable's AI Assistant provides tailored advice and answers to tax-related questions. This guidance is specifically designed to align with German tax regulations.

- Error Checking: The system automatically reviews user inputs for errors or inconsistencies, helping to ensure accuracy in all submissions.

- Tax Preparation: Accountable generates the necessary tax documents, including VAT and income tax declarations, based on the processed data and AI-driven insights.

- Continuous Learning: The AI system continually learns from user interactions and updates to tax laws, ensuring that its advice remains current and relevant.

Benefits of Accountable

Accountable offers numerous benefits for self-employed individuals and small business owners in Germany:

- Time-Saving: By automating many aspects of tax management and bookkeeping, Accountable significantly reduces the time users need to spend on financial administration.

- Cost-Effective: With flexible pricing plans, including a free option, Accountable provides professional-level tax management at a fraction of the cost of traditional accounting services.

- Reduced Stress: The AI Tax Assistant and error-checking features help alleviate the stress and uncertainty often associated with tax preparation.

- Improved Accuracy: By leveraging AI technology and staying up-to-date with German tax regulations, Accountable helps ensure accurate and compliant tax submissions.

- Financial Insights: The platform provides real-time insights into financial health, helping users make informed decisions about their businesses.

- Mobility: With both mobile and web applications, users can manage their finances anytime, anywhere, providing flexibility for busy professionals.

- Peace of Mind: The tax guarantee offers additional reassurance, protecting users against potential liabilities arising from errors within the app.

Alternatives to Accountable

While Accountable offers a comprehensive solution for tax management and compliance, there are several alternatives worth considering:

- Vanta: Ideal for businesses needing to automate compliance processes across various frameworks like HIPAA and SOC 2.

- Jotform: A versatile form builder that can assist in secure data collection and management.

- Very Good Security (VGS): Offers a unique platform for handling sensitive data while ensuring compliance with regulations like PCI and GDPR.

- CoAuditor: A flexible compliance management tool suitable for businesses needing customized compliance solutions.

- Fusion: Simplifies information security and compliance activities, helping organizations achieve certifications like ISO 27001 and PCI DSS.

While these alternatives offer valuable features for compliance and data security, it's important to note that Accountable's specific focus on German tax laws and its AI-powered tax assistant make it a unique and highly specialized solution for self-employed professionals and small business owners in Germany.

In conclusion, Accountable represents a significant leap forward in tax management and bookkeeping for self-employed individuals in Germany. Its combination of AI-powered assistance, user-friendly interface, and comprehensive features make it a valuable tool for anyone looking to simplify their financial management processes. While alternatives exist, Accountable's tailored approach to German tax regulations sets it apart as a specialized solution for its target market.